The GTA is an attractive place to live, but many people are dissatisfied with its high auto insurance rates. One of the main reasons for this is the use of postal code data to price auto insurance based on region statistics.

“Postal code discrimination” is what many are calling it. When pricing your auto insurance, companies will look at a lot of factors, such as your age, gender, driving record, and the vehicle you drive, but also where you live. Why? Well, it all boils down to the number of claims and the frequency of payouts in the area that you live. If you’re a good driver who’s never made a claim in your life, this can work against you, and you’ll pay a lot more for your insurance just by residing in the GTA.

Why are car insurance rates in the GTA so expensive?

According to the Financial Services Regulatory Authority (FSRA), the average auto insurance premium in the GTA in October 2022 was $2,245/year. The GTA is Canada’s most populous metropolitan region, meaning a lot of vehicles are on the road, which equals more accidents and more claims.

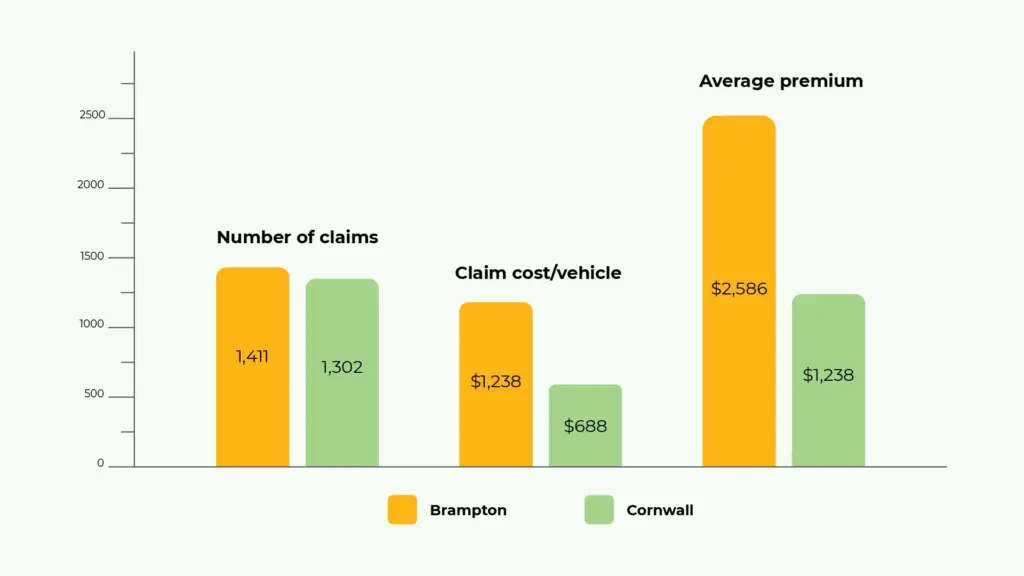

Let’s compare Brampton (in the GTA) and Cornwall (in Eastern Ontario) in 2021:

Insurance claims and rates in Brampton vs. Cornwall, Ontario (2021)

View the chart above as a table:

| City | # of Claims | Claim Cost/Vehicle | Average Premium |

|---|---|---|---|

| Brampton | 1,411 | $1,238.08 | $2,585.57 |

| Cornwall | 1,302 | $688.22 | $1,238.08 |

| Data Source: gisa.ca – 2021 Special FSA Analysis Exhibit | |||

As you can see, despite there being a similar number of claims made the insured claim cost per vehicle in Brampton is nearly double that of Cornwall. By the same token, drivers in Cornwall are paying less than half in annual premiums than drivers in Brampton.

Postal-code dependent or territory-biased insurance rating systems can negatively affect good, experienced drivers who otherwise don’t make many claims (if any at all) and have a clean record.

Even the best drivers in the GTA might have premiums like that of younger, inexperienced drivers living in provinces with lower rates on average due to the inflated auto insurance rates that drivers in Toronto and the GTA tend to see.

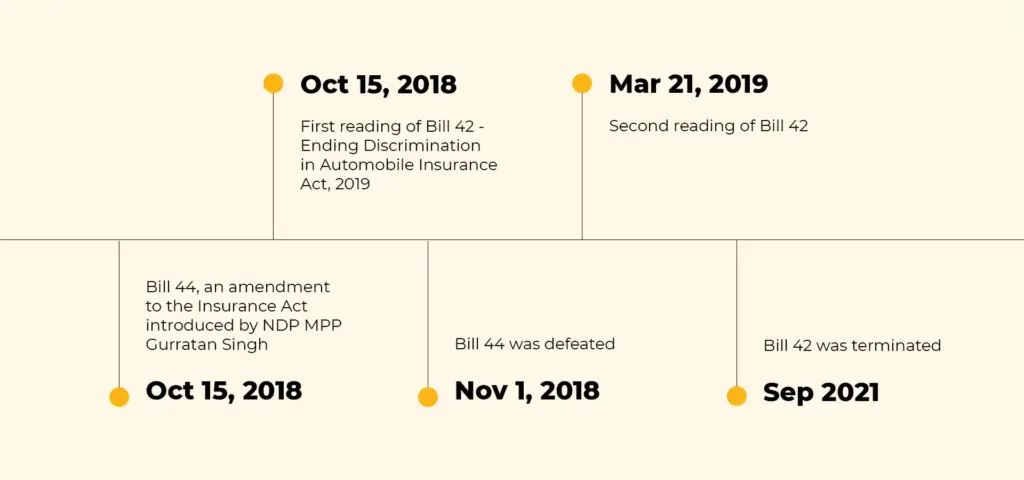

Ontario’s MPPs taking action against postal code discrimination (2018-2021)

Initially introduced by NDP MPP Gurratan Singh in 2018, Bill 44 aimed to end auto insurance discrimination in the GTA. This bill, if it were passed, would have brought down the prices of auto insurance for thousands of households. It would have prevented insurance companies from charging GTA residents higher rates than drivers in other cities solely based on where they live, and insurers caught using “discriminatory underwriting systems” would face penalties as detailed by the Insurance Act in the province of Ontario.

In November 2018, the bill was defeated 35-24. A second bill later emerged, taking issue with the lack of consumer choice in automobile insurance by attempting to prohibit insurers from using factors primarily based on a person’s postal code/telephone area code. Bill 42, Ending Discrimination in Automobile Insurance Act, 2019, passed both its first and second readings, however, it was terminated when the provincial parliament was prorogued in September of 2021.

Progression of insurance pricing reforms in Ontario – 2018 – 2021

Data sources: canadianunderwriter.ca – Legislature defeats bill quashing territorial ratings in Toronto area; mcmillan.ca – Upcoming Changes to Ontario’s Auto Insurance Regime

A “small town” perspective:

A rationale proposed by the insurance industry for using postal codes to calculate insurance rates, rather than Bill 44’s proposed “entire territory/area of coverage” perspective of the GTA, was that anyone who lives in a small town would statistically be less likely to be involved in an accident, and therefore should pay less. For those that it works in favour for, postal-code priced insurance is a good thing – yet only small town or rural families benefit from it.

As it stands, removing postal codes as a pricing factor for auto insurance can help drivers in expensive areas like Brampton or Toronto, but it may do little or nothing for those in lower-risk areas – or, oppositely, even hike their rates, since risk will be spread out more evenly.

Would eliminating the postal code system make auto insurance cheaper?

It depends on who you are and where you live. Doing away with the postal code system is an extremely popular notion, but it’s most beneficial to those who live in areas with higher auto insurance prices. Eliminating the postal code system altogether wouldn’t automatically drop car insurance premiums. It would just offset the costs and equalize them across drivers in Ontario, increasing the rates of those in smaller, less populated areas. Ontario as a province would still face the same average rates.

Another option for combating the postal code system, is opting in to usage-based insurance (UBI). UBI can offer an individualized discount to offset premiums that are inflated by the statistically high claim rates of where you live. If you’re a good driver, you can save as much as 25% in some cases. However, UBI programs can also surcharge you for bad driving behaviours as well.

Best auto insurance companies in Ontario 2023

Where are we at in 2023 with postal code auto insurance discrimination?

The Insurance Bureau of Canada (IBC) has long since accepted that the current way insurance is priced in Ontario needs an adjustment, although the reform the organization is pushing for seems to be more in the way of following another province’s lead: Alberta.

In 2020, Alberta’s regulator changed its auto insurance pricing rules. This has allowed for a more accurate rating for policyholders, while enabling insurers to have more flexibility in competing for customers’ business.

Both Bill 103 and Bill 12 emerged in 2022, aiming to prevent discrimination for vehicle insurance rates in the GTA. The IBC has cautioned that, yes, change is certainly needed, but the bills being proposed may not achieve what is necessary to reduce costs (and would present the issues mentioned above with smaller towns at a lower risk seeing increased rates).

While it’s safe to say that the FSRA and the Ontario government currently recognize the need for change, it’s difficult to say what form it will take.

Thanks to Alex Gemmiti (BSc, CIP, RIBO), Mitch’s service team manager, for reviewing this post