March is Fraud Prevention Month, an annual campaign that aims to identify, prevent, and report fraud. Insurance fraud is a huge issue across Canada and costs policyholders over $1 billion a year in added premiums. Plus, it puts more strain on our health care, emergency service, and court systems. When one person cheats, we all end up paying.

Recognizing the different types of insurance fraud, what to do if you suspect fraud, and how to prevent fraud are crucial to avoid becoming an unwitting victim.

What are the five most common types of insurance fraud?

Insurance fraud entails the intentional misuse of insurance coverage or its applications to achieve a favourable outcome. This often involves filing an exaggerated or false claim or deceiving your insurer in another way. In short, insurance fraud exploits an insurance contract rather than protecting the insured.

Here are the five most common types of auto insurance fraud:

- Staged collisions, where drivers intentionally cause crashes with unsuspecting drivers (and usually make it seem as if the innocent driver is the one at-fault)

- False information on policies, where someone misleads their insurer by providing false info, such as the make/model of vehicle, address, etc.

- Automotive repair and towing companies, who overbill insurers to drive up costs.

- Healthcare clinics, which have you sign blank accident benefits forms and charge insurers for services that were never provided.

- Stolen vehicles with false VINs, that are sold to unsuspecting drivers.

Identifying fraud: Opportunistic vs premeditated

Auto insurance fraud can be broken down into two different categories: opportunistic and premeditated. These are defined as follows:

Opportunistic

Following a legitimate loss, a policyholder seizes the opportunity to make an exaggerated claim to receive an unwarranted insurance payment. Some examples of this are:

- Including pre-collision vehicle damage in an auto insurance claim

- Inflicting additional damage to a vehicle post-collision

- Misrepresenting what happened so uninsured losses can be claimed

- Making a claim for property that wasn’t stolen during a legitimate break-in

- Lying about the condition, value, or mileage of a vehicle that was stolen

- Exaggerating injuries following a collision:

- Faking lingering injuries for extended recovery time

- Accepting “free” healthcare treatment for injuries unrelated to a collision or that are considered not medically necessary

- Encouraging others, such as drivers involved in a collision, to participate in fraud

- Healthcare practitioners exaggerating a patient’s injuries to increase the billed amount for treatment, assessments, and assistive devices

Premeditated

Premeditated fraud involves carrying out intentional, deliberate actions to make a claim for an insured loss event. Premeditated fraud not only raises auto insurance rates for everyone, but it can involve severe bodily injury or even loss of life to unsuspecting victims. Examples of premeditated fraud include:

- Submitting claims for fake losses

- Plotting out vehicle collisions with unsuspecting drivers, or with other (consenting) fraudsters. Examples of staged collisions include:

- Jump ins, when someone who isn’t a participant in the collision makes an injury claim against you with the hopes to get a settlement from your insurance

- Drive downs, when a driver in a parking lot waves you out of a spot and then plows in to you to make it seem like you weren’t looking when pulling out

- Swoop and squats, when a driver bolts in front of another to cause a rear-end collision

- Burning vehicles

- Purchasing fake insurance cards (or pink slips, as they’re also known)

- Providing false information to avoid paying premiums

How does fraud affect other drivers?

Over 74% of Canadians are aware that insurance fraud impacts their insurance premiums, showing how much this crime has grown in frequency and severity.

If you didn’t already know, yes, insurance fraud can result in higher taxes and greatly increase your insurance costs. Consider this: who ends up paying for the additional legal bills if an insurance fraud case ends up in court? Whose premiums go into the overall pool of funds used to pay out claims? Whose taxes help pay for police investigations of collisions?

Beyond costs, insurance fraud can also cause:

- A strain on emergency services and law enforcement, as fewer police are available to respond to legitimate emergencies and crimes

- Additional costs for policing services, which may result in higher taxes or service cuts

- Additional costs for health care services which may result in higher taxes or service cuts

- Longer wait times for diagnostic tools and X-rays as our healthcare system is clogged up with falsified injuries from auto fraud cases

- Courts are delayed by insurance fraud causes, so justice can be slowed for legitimate cases and crimes

- The justice system is faced with additional costs, which can result in higher taxes or service cuts

Prevention: Tips for avoiding fraud

Given the current economic landscape, it’s more important than ever for all Canadians to remain vigilant and take the necessary steps to protect themselves against fraud. Here at Mitch, we recommend the following to help prevent fraud if you are involved in a collision:

- Always contact your insurer first if a third-party tries to push you towards an unknown automotive repair shop, legal representative, or health professional

- Only see medical and legal professionals that you trust or are recommended by individuals that you trust/know

- Be aware of what your medical benefits are and what is covered

- Contact legal or medical licensing regulators in your province to ensure that the service provider you are in contact with is licensed

- Keep records of all your medical appointments, including dates and locations as well as names of practitioners, diagnoses and services, and records of medicine/supplies, or treatment that was provided

- Make sure to compare your records against the statements your insurer provides to ensure all bills are accurate and no goods/services are included that you did not receive. Advocate for yourself if something seems amiss

- Avoid signing blank insurance claim forms

- Finally, be aware of what your final settlement includes

You can help prevent insurance fraud

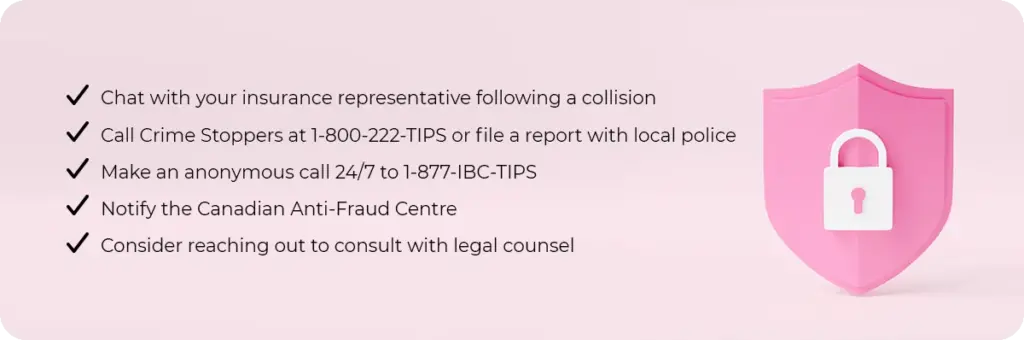

While law enforcement does their best to prevent insurance fraud, everyone can help make a huge difference by reporting fraud if they’ve witnessed or have information about a potential crime.

Follow these steps to do your part in preventing insurance fraud:

- Chat with your insurance representative following a collision

- Call Crime Stoppers at 1-800-222-TIPS or file a report with local police

- Make an anonymous call 24/7 to 1-877-IBC-TIPS

- Notify the Canadian Anti-Fraud Centre

- Consider reaching out to consult with legal counsel

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance.

Call now

1-800-731-2228