Getting into a car accident can be stressful, and it’s in these moments that we’re glad we have insurance. Unfortunately, the insurance claims process isn’t always straightforward, and industry trends have us experiencing longer delays than usual.

Here’s what to expect when you submit a car insurance claim.

It could take longer than you might think to receive your settlement

Insurance claim processing time varies based on accident circumstances, case complexity, and provided documentation. More evidence like photos, receipts, and witness statements can expedite the process. Claims usually take between 4-6 weeks to settle and all personal injury and damage claims tend to be finalized within 18 months (about one and a half years). Keep in mind that claims tend to resolve faster with thorough documentation.

Let’s explore the different stages that take place when you submit an auto insurance claim.

Step one: First Notice of Loss

Reporting the accident is usually a good first step, but this isn’t necessary if no one was hurt in the accident or the total damage is estimated to be less than $5,000. Either way, you’ll want to keep your broker in the loop – just in case the claim evolves or the other party (if there is one) decides to file a claim against you later.

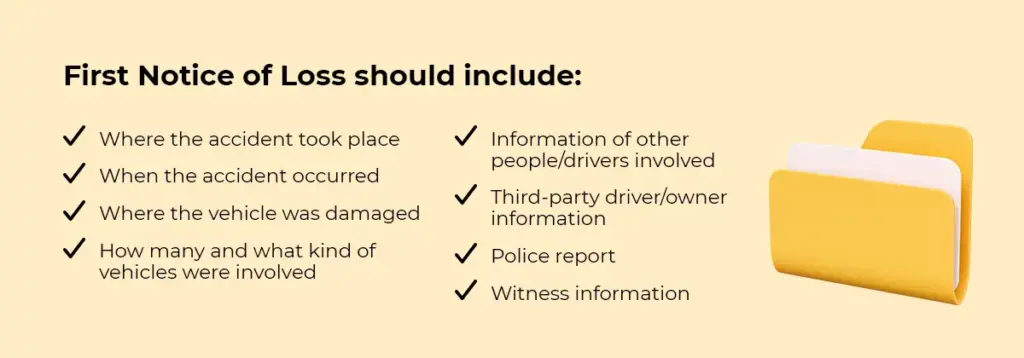

The claimant, aka the policyholder, submits the initial application to put in an auto insurance claim. You can do this with a broker and this is known as the First Notice of Loss, or FNOL for short. This “report” should include the following details:

- Where the accident took place

- When the accident occurred

- Where the vehicle was damaged

- How many and what kind of vehicles were involved

- Information of other people/drivers involved

- Third-party driver/owner information

- Police report

- Witness information

The FNOL isn’t an insurance claim but the intention to put in a claim. For the insurance company, it acts as the first part of the claim investigation.

Note that with current industry delays, some insurers will reach out within 48 hours (about two days) of the FNOL, but others may not contact you until after 10 days (unless an injury is part of your claim). Make sure your voicemail box is open for calls and be sure to keep an eye on your email (as this is sometimes the initial point of contact) so that a message from your insurance company isn’t missed.

Step two: Verifying coverage

The next step in an auto insurance claim is to gauge if the policyholder has coverage for the occurrence. Usually this is where the claims adjuster comes in. They’ll investigate the situation to determine whether a claim can be accepted. For example, a claims adjuster might deny a claim if the policyholder rolled over or hit a streetlamp and they didn’t have collision coverage in their policy. To assess if coverage is applicable, they’ll examine the details of the accident, discuss it with the driver, talk to witnesses, review damages, and do anything else needed to come to a fair conclusion on whether to accept or deny the claim.

Step three: Evaluating vehicle damages

Once insurance coverage has been confirmed, the claims adjuster will evaluate the damage done to the policyholder’s vehicle in addition to any property damage suffered by third parties (others involved in the accident that are not the insured).

Things the adjuster will do at this stage include:

- Gauge if the vehicle is repairable or not. If it can be repaired, it may be sent (or towed) to a repair shop of the insurance company’s choice (or the repair shop of your choice, if you have a preference). They may also call in a vehicle damage appraiser to the location of the accident.

- Should the vehicle be deemed repairable, the adjuster will then evaluate a repair estimate that is submitted by an independent appraiser, in-house appraiser, or repair shop. Once the estimate has been approved, repairs can be scheduled.

- Evaluate if the vehicle is drivable. If not, they may help to have it towed to a secure location, and if the vehicle cannot be repaired, they may arrange to have it towed to a salvage yard.

- Request for damage estimates from the garage. The garage will create a formal report of the damage and estimated time to repair.

Step four: Claims negotiation

Once the investigation is complete, the claims adjuster will determine your entitlements according to your auto insurance policy. Typically straightforward, this process leads to a decision by your insurer on whether to repair or write off the vehicle. Your insurance company will usually choose the most cost-effective solution. If repair costs exceed the vehicle’s value, insurers will generally opt to write off the car as opposed to paying to fix it.

If your provider decides to write off your vehicle, but you want to keep it and repair it yourself, this may be possible through an owner-retained salvage agreement. In this instance, your insurance company would deduct the salvage value of the car from the payout for your claim.

Step five: Claims settlement and payment

Once negotiation is complete, the last step of your claim is payment or compensation. If your vehicle is written off, this is based off replacement cost or actual cash value – whichever is in your policy. If you have OPCF 43 (aka a Waiver of Depreciation, which ensures your insurance pays the actual purchase price without subtracting depreciation if the car is less than 3 years old), this will also change how your insurance company perceives the value of your car.

If your vehicle is being repaired, you’ll have to pay your deductible and then your insurance company will step in to pay the remainder of the costs.

Why is my settlement taking so long?

The insurance industry is currently experiencing severe shortages of adjusters and appraisers, both of whom are crucial to the claims process.

For auto accidents where there’s more significant damage and a vehicle “teardown” is required to assess internal damages, or where there’s a strong possibility that the vehicle could be a total loss and must be reviewed by the insurer’s appraisal team, there’s usually a severe backlog. This is true of every insurance company, with the shortage of labour being felt industry wide.

If a vehicle is deemed repairable, then the wait times for repair shops come in. This varies by region, but the average time it takes for a vehicle to be booked in is around 30 days. Repair shops are experiencing a shortage of mechanics and parts, making for longer repair times.

If your vehicle is drivable, it may also take longer for your repairs to be scheduled since the shop won’t consider your car a priority. This is because you likely won’t be incurring rental costs, so you might end up waiting a few months. You might even receive your repairs in stages to ensure they can get the parts you need while they’re available. Some parts take longer than others, and there’s no standard list for what parts are harder to get.

If the vehicle is considered a total loss, it goes from appraisal to the total loss team (adjusters whose specialty is total loss vehicles) where, unless you have OPCF 43 (an endorsement which changes how your insurance company values your vehicle) a fair settlement is calculated. Usually, you’ll receive an offer around 7-10 days (about 1 and a half weeks) after the total loss has been determined.

Every company has a Consumer Complaint Officer who oversees the process of complaint-handling. For your convenience, FSCO has compiled a list of company Consumer Complaint Officers. You can access this list online at: www.fsco.gov.on.ca.

What we recommend

If it ever seems like you’re stuck and your claim is taking forever to go through, know that you’re not alone. Delayed claims are becoming an industry-wide experience and it’s tough to say when the wait times will begin to improve. If you’re dealing with a drivable vehicle that’s awaiting repairs, you’ll need to keep in touch with the repair shop rather than the adjuster for updates. On the other hand, if you’re dealing with a total loss, you might want to research your same make/model of vehicle on dealerships, auto raters (online tools or systems used to evaluate vehicle’s price based on their various aspects), etc. for an approximation of what your car’s value will be. Keep in mind that online marketplaces like Facebook Marketplace, Kijiji, etc., are not acceptable forms of comparison, even if that’s where you purchased your car.

An adjuster should be able to give you a rough timeline once the claims process has begun, so keep that in mind. While you can contact your adjuster to ask for updates, you’ll likely need to accept the timeline they’ve offered as there isn’t much they can do to speed up the process.

During this time, feel free to contact your insurance broker with any questions. They may be able to request updates for parts or estimates on your behalf or can give you some additional insights into what’s going on behind-the-scenes.

When do you not have to file an insurance claim?

Sometimes, you won’t have to file an insurance claim. This could be because:

- The cost of damage is less than your policy’s deductible

- You and the other party decide to settle privately

- If there was no property damage, injuries, or a bill involved – i.e., you backed into a tree stump on your own property

It’s generally a good idea to inform your insurance broker about car accidents regardless of if you intend to file a claim or not, particularly those involving other parties. You can let you broker know not to report back to your insurer but having them at least aware of what happened can ensure that they’re able to provide you guidance on the best course of action.

Questions? We’re here to help

When bad things happen, it’s good to know you have insurance to cover you. We understand you might be feeling overwhelmed during these difficult times. Mitch is here to answer any questions and support you throughout the insurance claims process. Get in touch to learn more about how we can help with your claim.

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance.

Call now

1-800-731-2228