A lot of drivers might think of the occasional risky move as no big deal. The odd hasty U-turn, tailgating, speeding, or even aggressively cutting someone off in traffic—they might not be the best driving practices, but no harm, no foul, right?

Unfortunately, dangerous driving can have serious consequences. In this article, we explore some of the most common risky driving behaviours, the possible penalties on your insurance rates, and some tips for better road safety.

Over half of Ontario motorists engage in risky driving behaviour

A study recently conducted by CAA South Central Ontario (or CAA SCO for short) discovered that 55% of Ontario motorists confessed to engaging in unsafe or dangerous driving behaviours in the past year. That is quite a lot, given that in 2021 there was an estimated 11,040,417 licensed drivers in the province. Furthermore, the percentage of drivers admitting to dangerous driving increased to 61% with young people between the ages of 18 and 34.

So, what does this mean? Well, with Ontarians frequently participating in and witnessing dangerous driving behaviours, the odds of a collision are that much greater. More collisions means a less safe driving environment for everyone—and ultimately, higher insurance costs. We’ll elaborate more on the topic of insurance later in this article.

Ontarians recognize their driving behaviours are worthy of penalty as well; in fact, many motorists go out of their way to avoid roads with automated speed enforcement (ASE) cameras. The same study conducted by CAA SCO found that 40% of Ontario drivers surveyed will actively avoid roads where these devices are installed.

Top dangerous driving behaviours

The study also identified several common dangerous driving behaviours. These actions were not only dangerous to the drivers themselves, but also put other motorists, pedestrians, and cyclists at risk.

Here are the five most common dangerous driving behaviours:

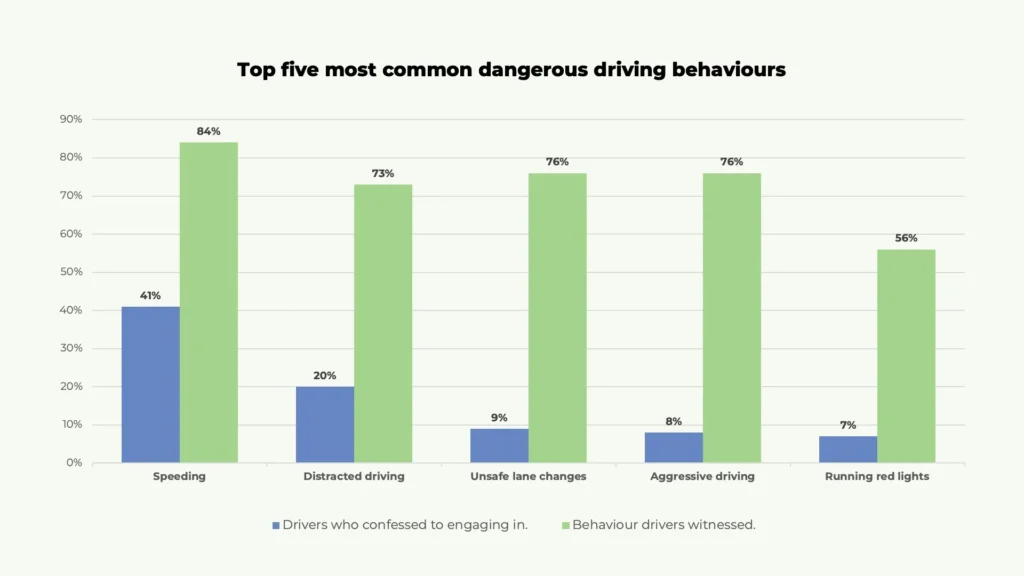

- #1: Speeding (41% of participants)

- #2: Distracted driving (20% of participants)

- #3: Unsafe lane changes (9% of participants)

- #4: Aggressive driving (8% of participants)

- #5: Running red lights (7% of participants)

The study also highlighted dangerous driving behaviours that participants witnessed as well. Here are the most frequently observed behaviours:

- #1: Speeding (84% of participants)

- #2: Unsafe lane changes (76% of participants)

- #3: Aggressive driving (76% of participants)

- #4: Distracted driving (73% of participants)

- #5: Running red lights (56% of participants)

Given the data shows us that it’s more likely for people to notice others driving dangerously than admit to driving dangerously themselves, it’s safe to assume that a lot more people participate in risky driving behaviour than we might expect. Speeding, specifically, is a leading concern for motorists in Ontario and is a major factor in high collision rates—especially for young drivers.

Dangerous driving penalties in Ontario

We’ve covered the topic of dangerous driving penalties in Ontario previously, but to recap: dangerous driving can lead to a temporary license suspension and even jail time and a criminal record.

Careless driving and dangerous driving are different things in the eyes of the law. The difference between the two is intent: where careless driving is simply lacking in care, dangerous driving is intentionally putting the public at risk with the way you operate your motor vehicle. Careless driving will typically result in six demerit points and a fine, but occasionally jail time and a license suspension as well.

While dangerous and careless driving both come with different legal penalties, they have similar effects on your insurance. Both will probably push you into the high-risk category for the next three years, and you’ll be paying double or triple your current insurance rate.

How does dangerous driving affect my auto insurance?

There are many factors that influence your auto insurance rates, including your age, gender, vehicle, how often you drive, and so on. You might think that if you drive safe, dangerous driving won’t impact your insurance. Unfortunately, that’s not exactly the case. Dangerous driving contributes to higher collision rates and consequently more auto insurance claims. The more an insurance company pays out in claims, the more its pool of reserve funds for claims diminishes. To balance this out, rates may need to rise across the board—meaning your rates could go up to compensate for others’ dangerous driving, even if you’ve never had a ticket or accident.

And if you’re the one partaking in dangerous driving and wind up getting into a collision or receiving a ticket, your rates are likely to be even worse off. As we mentioned above, it could launch you into the high-risk category, meaning insurers will see you as two or three times more likely to make a claim.

Solutions for high-risk drivers

If you’ve ever been convicted of dangerous or even careless driving, you could end up being labelled as a high-risk driver. This may mean paying double or triple your existing insurance rate. This can be concerning for many who are looking to keep costs low, but luckily there are ways to offset or at least slightly reduce the increase in rates.

One option for high-risk drivers (and any driver looking to save on their coverage) is to opt into their insurer’s telematic program. Most major auto insurers offer this to reward good driving behaviours with discounted insurance. Telematics have also been shown to improve driving habits (such as speeding) as you’ll be more conscious about the things you do.

Call Mitch Insurance for affordable car insurance

As rates rise due to a collective number of escalating issues, including dangerous driving, car insurance becomes less and less affordable. Thankfully, Mitch Insurance has options to help you save on your coverage. Give us a call for a free quote today.

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance.

Call now

1-800-731-2228