The unexpected passing of a loved one is not something anyone wants to think about. The burden of having to tie up all their loose ends can be overwhelming for anyone, and too few people consider the implications of someone passing away while still having an active insurance policy. What do you do?

When in doubt, we recommend contacting the deceased’s insurance broker or company for help. To give you a clue of next steps, let’s explore some scenarios to determine what happens to an insurance policy after the policyholder dies.

Steps to take following a policyholder’s death

When a car, home, or other personal insurance policyholder (save for life) passes away, how their policy is then handled will depend on the specific situation. Provided the policyholder has a will or executor, the process can be relatively simple. It gets a little more complicated if the death of the individual was unexpected or happened prior to obtaining a will.

Here are some steps to take following a policyholder’s death:

- Notifying the insurer. Upon the insured’s death, it’s crucial to notify the insurance company that the person has passed away. Whether you’re able to talk with the deceased’s broker may hedge on if your loved one had a will or executor. In the absence of a will, it can be challenging to terminate an active policy.

- Documentation for executors. This step only applies if you are the assigned executor of the deceased’s estate and not listed on the policy. You’ll need to acquire documentation that you are, in fact, the assigned executor, as this is crucial for policy cancellation.

- Continuation of policy. Insurance can be transferred over easier if there’s another person named on the policy, but a new policy will need to be created if that’s not the case. The policy remains “in the estate of” the deceased person until the property title is transferred. Coverage on a homeowner’s policy changes if the dwelling is vacant, so we advise reaching out to the broker of the deceased ASAP for options.

Scenarios for transferring or terminating policies of the deceased

Certain scenarios may make it more difficult to transfer or terminate an insurance policy. Things move a lot smoother when the insured has an assigned will or executor, which is why we’d recommend policyholders of all ages consider preparing one. Doing so can reduce the burden on others having to tie up your loose ends following your passing.

The death of a spouse who is the insured

Cancelling or transferring a policy as the spouse of the deceased insured is easier with a will but still very possible, as you (as their spouse) are technically the one who inherits the policy following their passing. Depending on whether you’re looking to transfer or terminate the policy, you’ll still need to provide documentation such as a probate form or death certificate.

The death of a relative (on a separate policy) who is the insured

If the insured who passed away was a nephew, sibling, parent, etc. whose policy you were not listed on, it can be extremely challenging to terminate the policy without a will or executor. You likely won’t be able to speak to the deceased’s broker or insurer without documentation to prove your status as an executor. While the status of the deceased’s vehicle is being decided, the policy will likely remain active.

If the asset in question (the item being insured under the deceased’s policy, whether a car or a home) is not going to be used, the policy should always be cancelled. If the asset is going to be used, either the executor or estate’s legal administrator must have the vehicle registration transferred over. Again, this may be more difficult to do without a will or assigned executor. In some situations, we may advise stopping payments, so the policy cancels due to non-payment.

Cancelling car insurance for deceased policyholders, step-by-step

Keeping a car insurance policy is only valuable so long as there’s a reason to have insurance, such as if someone plans on driving the vehicle.

Step-by-step, here’s how to cancel auto insurance for a deceased policyholder:

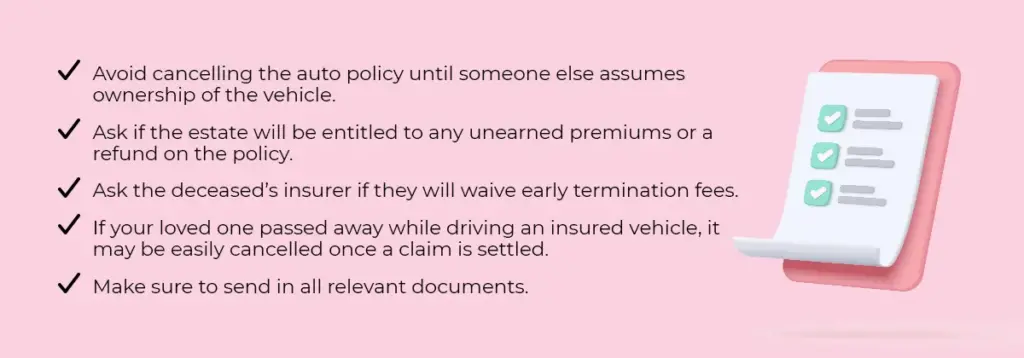

- Avoid cancelling the auto policy until someone else assumes ownership of the vehicle or once a sale has gone through.

- Ask the deceased’s broker or insurer if the estate will be entitled to any unearned premiums or a refund on the policy.

- You may also wish to ask the deceased’s insurer if they will waive early termination fees, given the circumstances of your loved one’s passing.

- If your loved one passed away while driving an insured vehicle, odds are that the vehicle will be written off as a total loss. If that’s the only car covered by the policy, it may be easily cancelled once a claim is settled.

- Finally, make sure to send in all relevant documents, including a certified death certificate and proof of your role as an executor. Again, without this, it can be difficult to terminate an insurance policy without a will or assigned executor.

How do you cancel an insurance policy when there’s no will or assigned executor?

Having a surviving spouse, written will, or estate executor can make transferring or terminating a policy simpler. But what happens if you need to cancel a loved one’s insurance policy if they passed away unexpectedly without a will or assigned executor?

As brokers, here at Mitch we are unable to take direction from anyone other than the executor following an insured’s passing. If there is no will, we can obtain proof (such as a death certificate) and reach out to the insurance company to see what steps can be taken to cancel a policy. Insurance companies may be able to cancel an auto policy that no longer has a valid driver.

Technically, a policyholder’s coverage is no longer valid once they’ve passed. If you should run into any issues, be sure to contact a broker at Mitch to discuss the best course of action.