In an April 2017 report, Special Advisor to the Minister of Finance in Ontario, David Marshall, pegged the average Ontario car insurance premium in the year 2015, at $1,458 per vehicle—a figure almost 55 percent higher than the average rate for the rest of Canada. We discuss this in more detail in an earlier post.

For those living in and around Hogtown (The 6 for trendier sorts), it gets worse; premiums are as much as $1,000 higher than the Ontario average. And depending on individual circumstances, the actual price vehicle owners living in the Greater Toronto Area (GTA) pay for car insurance can be substantially higher.

The variables of rating

A number of factors affect how much we pay for automobile insurance in Ontario:

- Rating class (based on vehicle usage, driver age, gender, marital status)

- Years of continuous licencing in North America

- Accident and conviction record

- Qualification for discounts (multi-policy, driver training, loyalty etc.)

- Coverage (limits, deductibles, and optional extensions)

- Vehicle type, model, value, and safety features

- Rating Territory – address / area of operation

Insurance companies employ actuaries to collect and analyze claims data. Actuarial science is an entirely objective exercise; it applies mathematics, statistics, and theories of probability to predict claims patterns for hundreds of relevant risk components. Loss costs are captured and rates projected for risk variables relating to the driver, vehicle, usage, location, and coverage.

The goal of insurance rate-makers is to allocate premiums in proportion with the accidents and claims patterns for established risk profiles. Higher premiums are charged for profiles with a history of claims activity and the most competitive rates are reserved for bands of business producing the best results.

Unlike the stock market, when it comes to automobile claims projections, past performance is indicative of future results.

Hitting you where you live

For the purpose of this article the focus is on the price implications of rating territory.

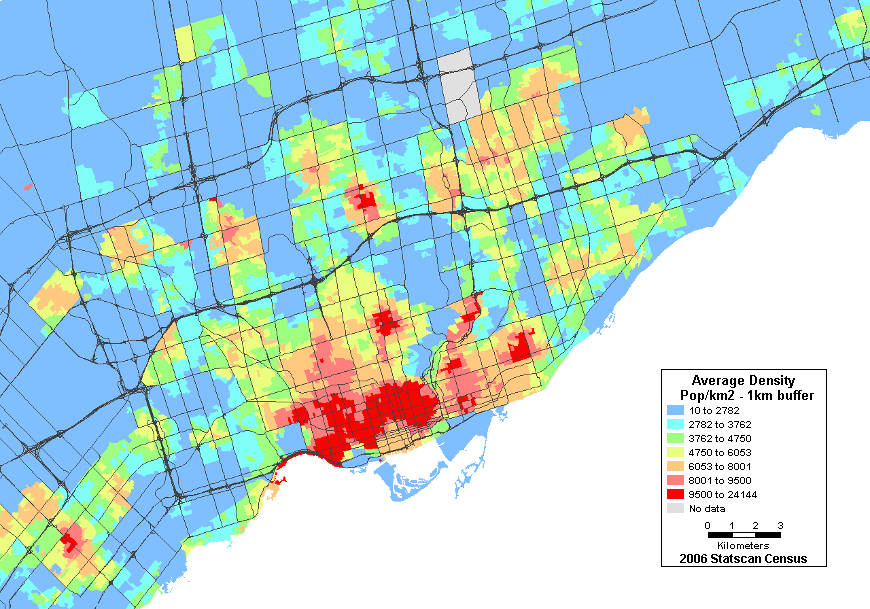

Insurers produce rate tables for dozens of geographic territories based on cumulative experience and the anticipated losses for vehicles in those territories.

The larger the pool of data the more credible the analysis and there is sufficient volume of business and variation of claim patterns, in the GTA, to produce rates at a postal code level. While car owners throughout the Greater Toronto Area may bristle at the idea of paying higher average rates than the rest of Ontario, those living in Brampton have the dubious distinction of paying the highest territorial rates in the province—and quite possibly, the country.

How is that fair?

Safe-driving GTA-dwellers—and especially sticker-shocked Bramptonians—could be forgiven for crying foul:

If I have a clean driving record, why in the name of QEW gridlock should I be paying more than someone living in Peterborough, Cobourg or Stratford?

Accident frequency and costs are substantially higher in the GTA than in other municipalities and rural communities, and they spike significantly in the city of Brampton.

The merits of individual drivers allow for some pricing relief within territorial rating tables, but the territorial factor generates a higher starting point.

So why are claims higher in the GTA?

While actuaries focus more on crunching numbers than exploring the reasons behind them, insurance brokers, underwriters, and risk managers have an interest in understanding the why behind the results. An awareness of contributing conditions precedes risk and premium management strategies to differentiate the best in class.

What contributes to the adverse claims experience in the GTA?

Traffic density

One of the surest contributors to more claims is more traffic. It doesn’t take long for drivers visiting the GTA to get the feeling we’re not in Kansas anymore.

Few big city driving experiences compare to the rush hour ritual that funnels a time-pressed labour force towards the bloated bowels of commerce. Endless lines of vehicles aboard bulging tentacles of multi-lane pavement, weakly pulsating toward the city center while frazzled drivers hang their hopes on a fortuitous lane change that gets them to the early meeting on time.

Firm timelines in the face of unpredictable obstacles is rarely a winning formula. Impatience and inattention are the wildcards that checker the route with crumpled fenders and raise the stakes in the lane change lottery. And if it should rain, or heaven forbid, snow, all bets are off.

Whether it’s highway commutes or local navigation of busy city streets, mistakes are magnified in higher density traffic communities. A split second of distraction, failure to check a blind spot, pushing the limit with changing traffic lights, or general frustration—errors in crowded surroundings are more apt to result in damage to vehicles and injuries to occupants or pedestrians.

Force of habit

Long-term residents of the GTA are likely more than familiar with the nuances of local driving conditions and the safe drivers respond accordingly. But mega-cities like Toronto include significant numbers of newer arrivals and visitors that import driving habits from entirely different environments.

Having spent my first driving decade in Toronto, before moving to London, Ontario, I can appreciate the distinction. Now, many decades removed, there is notably more hazard and anxiousness driving about the GTA than in the slower-paced, less aggressive conditions closer to home.

The GTA is home to an extensive mosaic of cultural diversity. Whether it’s the influence of alternative conditions in this county, or international experience introduced into to mix, unexpected driving behaviours from overly cautious or unusually aggressive drivers, undoubtedly increase the likelihood of accidents.

Insurance fraud

According to the Insurance Bureau of Canada (IBC), the additional claims costs associated with organized automobile insurance fraud drives up premiums by as much as 15 percent. These illicit operations are least conspicuous in the bustle of large urban centres and have been found to be particularly prevalent in Toronto.

Participants to fraudulent ‘accidents’ include, recruiters, who stage an elaborate sequence of events involving complicit towing services, body shops, medical clinics and paralegals. Unwary drivers are ‘set up’ for virtually unavoidable ‘at fault’ accident events. As legitimate as the incident may appear to victims and witnesses, the collision has actually been well-planned. This YouTube video from IBC offers interesting insight into these criminal scams.

Progress is being made by insurance industry fraud investigators and regional law enforcement services in identifying and successfully prosecuting these rings.

Vehicle theft

A type of automobile claim that generally rises in proportion to community size, is vehicle theft. In cities like Toronto, Ottawa, Mississauga, Brampton, and Hamilton, higher insurance rates reflect the incidence of vehicle theft.

As in the case of insurance fraud, there is often a greater chance of organized criminal activity in larger cities.

What can be done to keep premiums down?

Like most budgeting exercises, there are some things that are discretionary and others that are fixed. Not all options work for everyone, but here are a few thoughts that may interest some car owners.

- A key advantage of insuring through an independent broker is the objective guidance they lend and the range of options they can provide. The loss results and growth plans for any rating territory vary by individual market and their rating will often reflect it. There may be better pricing with a market performing better and growing in a given territory.

- The loss performance for risks based in the downtown core is better than most of the surrounding GTA postal codes. The likely reason is that more people take public transit to work and leave the car at home. Go trains and subways aren’t for everyone, but there are meaningful differences between drive-to-work and pleasure only ratings.

- A sufficient third-party liability limit is an important part of coverage adequacy, but one area premiums can be saved is with higher physical damage deductibles. To the extent vehicle owners are willing to assume a larger portion of any collision, comprehensive, and (not at fault) direct compensation claims, by way of increased deductible, there is a reduction in premiums charged.

The David Marshall report thoroughly examined the state of automobile insurance pricing in Ontario and changes are anticipated to deal with the inefficiencies of product and process that drive the cost of claims. The hopeful outcome for car owners—in the GTA and all other rating territories—is premium reduction that brings Ontario closer to the provincial average.

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance. Learn more >

Call now

1-800-731-2228

When I heard what Brampton residents pay, I was very surprised. Very high costs there.

Extremely high – it would amaze you to see the claims cost difference between Brampton and a rural town.

They give a different reason each time you ask. I am 67, drive 21 km to work. My last violation was in 2001. My wife had an at-fault in 2003. The last time we made a claim (for a window broken by a thief) was in 2006. Supposedly we’re getting a discount for bundling with our house insurance (no claims there either). Supposedly we’re getting a discount because I belong to a union. We drive a 2011 Hyundai, just a little under 20,000 km a year. And yet I’m paying way more than the average. They want $2890 for the car alone this time. I know a guy at work who has three cars and his house bundled for $3600. So what am I doing wrong?

1. Is it the 21 km I drive to work?

2. Is it my postal code M9W 1S6?

3. Are Hyundai Elantras more likely to run into other cars or people than the cars my co-workers/friends are driving?

4. Is my 8-year-old car an attractive target for thieves?

5. Whatever happened to “Older drivers are safer drivers”; are those days over?

6. A co-worker who lives in Burlington drives a Honda Civic over 40 km to work each way pays $1100 per year.

Please, what am I doing wrong?

Hey Will.

Sorry that your rate isn’t what you would like it to be. Because of privacy issues, we can’t answer your questions on this page. Certainly not without your consent. If you’d be so kind as to email Scott at slogan@nullmitchellwhale.com and give him some of your policy details, we’d be happy to look into what factors are leading to your less-than-ideal rates.

You’ve listed some of the top auto insurance rating factors; here’s a comprehensive list if you’d like to take a look at some others in the meantime.

Thanks, and hopefully we’ll hear from you soon.