Are electric cars more expensive to insure?

October 28, 2024

Electric vehicles, or EVs, are becoming more and more popular in Canada. With gas prices rising across the country, it’s easy to see why. From a budget perspective, doesn’t it make more sense to transition to electric power? Well, that depends – gas is only one aspect of vehicle ownership expenses. There’s also upfront cost, maintenance, repairs, and of course insurance.

Is electric car insurance more expensive than coverage for gas-powered vehicles? Let’s look.

Comparing insurance costs for EVs vs ICEs

We ran insurance quotes to see how the premiums of electric vehicles (EVs) and internal combustion engine vehicles (ICEs) stack up. We used the same scenario for both: A 35-year-old male, married, living in Carp, ON, driving 16,000 km per year, with no accidents in the last six years, and mainly using the vehicle for commuting. See our quote comparisons below:

| Insurer | ICE: 2015 Nissan Sentra | ICE: 2023 Volkswagen Taos | ICE: 2024 Kia Seltos LX | EV: 2015 Nissan Leaf S | EV: 2023 VolkswagenID.4 Pro | EV: Kia Niro EV |

| Aviva | $1,898 | $1,871 | $1,928 | $1,903 | $2,291 | $2,221 |

| CAA | $1,729 | $1,552 | $1,644 | $1,662 | $1,719 | $1,721 |

| Economical | $1,773 | $1,545 | $1,684 | $1,798 | $2,479 | $1,949 |

| Intact | $1,716 | $1,511 | $1,460 | $1,475 | $1,879 | $1,702 |

| Zenith | $1,794 | $2,169 | $2,351 | $1,652 | $2,286 | $2,420 |

| SGI | $1,637 | $1,411 | $1,505 | $1,575 | $1,723 | $1,661 |

| Wawanesa | $1,656 | $1,732 | $1,836 | $1,698 | $2,178 | $2,147 |

| Average | $1,743 | $1,684 | $1,772 | $1,680 | $2,079 | $1,947 |

Note that the prices listed above are unique to the fictional profile we created and won’t be the exact price you’ll pay for your insurance, even if you have the same model of car listed in the examples. Rates fluctuate based on more than model/make and may increase or decrease depending on your driving record, gender, experience, location, and more.

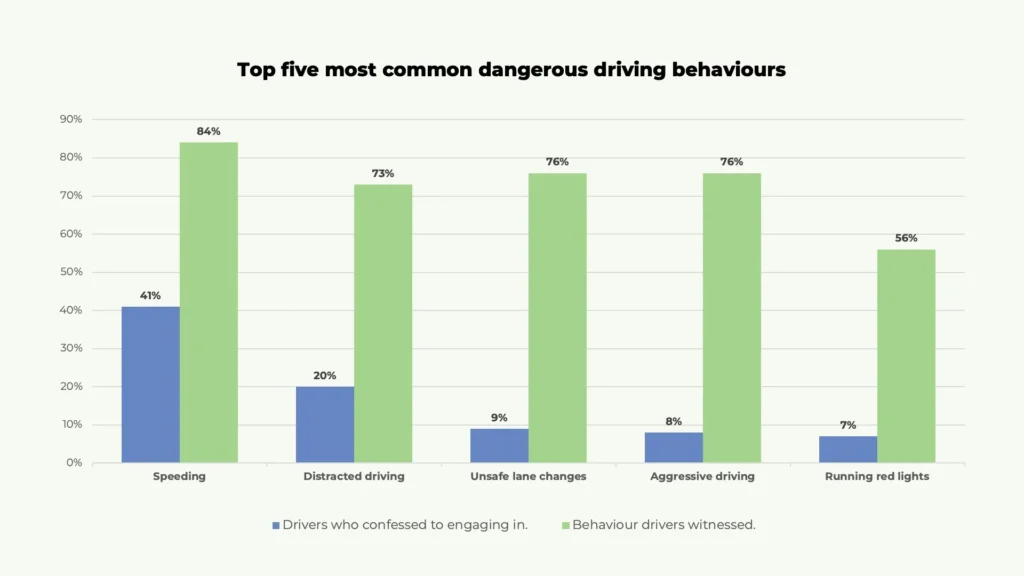

We discovered 2/3 of the EVs to be more expensive than their ICE comparison. Our key findings are as follows:

- It costs almost 4% more to insure the ICE 2015 Nissan Sentra than it does the EV 2015 Nissan Leaf S. However, some companies (Aviva, Economical, and Wawanesa) charged more for the Leaf than they did the Sentra.

- It costs around 20% more to insure the EV 2023 Volkswagen ID.4 than it does the ICE 2023 Volkswagen Taos.

- It costs about 9% more to insure the Kia Niro EV than it does the ICE 2024 Kia Seltos LX.

In some examples, the price increase is relatively small – or non-existent. It really depends on the individual EV being insured, the insurance company you’re with, and more.

How does the brand of EV affect your overall insurance cost?

The brand and type of EV can impact your insurance costs significantly, but this has more to do with the value of the car and its overall replacement cost.

Most electric vehicles are more expensive to buy upfront versus their ICE counterparts. A 2024 or 2025 S Volkswagen Tiguan is estimated to cost around $29,000, whereas Volkswagen’s latest electric offering – the Volkswagen ID.4 – starts at around $41,000.

As EVs become more popular, this upfront cost is projected to decrease. Also, Canada is currently offering the iZEV Program, which offers point-of-sale incentives for consumers who purchase or finance/lease a zero-emission vehicle. Passenger vehicles worth less than $55,000 and station wagons, pickups, SUVs, vans, and minivans valued less than $60,000 will be eligible for federal purchase incentives. Longer-range plug-in hybrid vehicles are eligible for up to a $5,000 incentive, while shorter range plug-in hybrid electric vehicles are eligible for up to a $2,500 incentive.

The vehicle brand can also influence the availability of parts if your EV needs repairs, especially if you have a higher-end model. Mechanics will also need to have very specific skills to be able to repair EVs, which may mean they’ll charge more.

How are electric vehicle insurance premiums rated?

Electric car insurance is priced the same way coverage is for ICEs. The key difference, and why oftentimes rates are slightly higher for EVs, lies in three main factors: the overall cost of the vehicle, the cost of repairs, and the lack of EV repair shop availability.

Cost of repairs

With all their high-tech features, EVs typically cost more to repair than ICE vehicles – especially the EV battery. All this can translate to higher premiums.

Vehicle cost

Most EVs on the market today are more expensive upfront, with even the cheapest EVs available still costing between $35,000-$40,000 (before federal incentives) brand new.

Availability of repair shops

Since EVs aren’t nearly as popular on the roads as ICEs are, there are limited mechanics and shops who have the training to repair electric vehicles. Since repairing EVs typically requires a specialization, it also means the mechanic can charge a higher rate.

Some insurers (Aviva, Intact, and CAA, for example) offer a discount for consumers who drive electric vehicles. Depending on the provider, the discount is anywhere between 5%-20%. This can help keep your rates within reason.

Canada’s 2026 electric vehicle sales mandate

The first quarter of 2022 saw the highest EV registrations ever recorded in the country, and in 2023 around 10% of all vehicles were registered as zero-emission vehicles. In a push to reduce fossil fuel dependency, new regulations posed by the federal government will require one fifth of all passenger vehicles, SUVs, and trucks sold in Canada to be electric powered by 2026.

The mandate goes further, with 60% of all sales in 2030 being for electric cars, and all passenger vehicles sold in Canada by 2035 required to be electric. Any manufacturers or importers who fail to meet the sales target could be faced with serious penalties. This mandate could help to bring down the cost of EVs as more and more of them start to appear on our roads, creating a higher supply of repair parts and could push more autobody shops to learn the specifics of how to handle and repair EVs. Ideally, this could help to bring down the cost of EV insurance.

There are, however, concerns surrounding the readiness of Canada’s infrastructure to support such a movement, so it remains to be seen how this will play out in the coming years. Some provinces, like Quebec and British Columbia, have already implemented their own mandates on electric vehicle use and as such are now steps ahead of the rest of the country.

Save on electric vehicle insurance with Mitch

It’s safe to say that the usage and prominence of electric vehicles will continue to increase in Canada. Whether you already drive an EV and are looking to save on your coverage, or you’re considering purchasing one and are interested in what your electric car insurance will cost, talk with one of our brokers today. They’ll make sure you have the coverage you need at the best price possible.

Looking for car insurance?

Speak with a Mitch Insurance broker today to get a quote on Ontario auto insurance.

Call now

1-800-731-2228