Insurance has been around for thousands of years, but how it works hasn’t really changed all that drastically. In a nutshell, insurance works by pooling together the payments (or premiums) of policyholders to help pay for insurance claims.

Ever wondered, “Where do my insurance premiums go?” Well, wonder no more because we’re going to answer that for you.

Understanding insurance language: Premiums, deductibles, and claims

Insurance lingo can be confusing. A few words you might often hear in reference to insurance are premiums, deductibles, and claims.

Premiums are also referred to as rates, payments, etc. They’re the monthly, semi-annually, or annual cost of your insurance. For example, for your auto insurance, you might pay $2,000/year in premiums, separated into twelve $166 monthly payments.

Deductibles are essentially a policyholder’s “percentage of risk.” They’re what you’d pay in the event of a claim before your insurer pays the rest. If your car was damaged in a collision and the total cost of repairs totaled $3,200, and you had a $500 deductible, you’d have to pay the $500 towards the repairs before your insurer covered the remaining $2,700.

Claims are what you’d file with your insurer if you got into a wreck, like a request for compensation per the terms of your insurance contract. If you got into a car wreck, you’d file a claim with your insurer that would be covered according to your policy’s conditions.

What are insurance premiums used for?

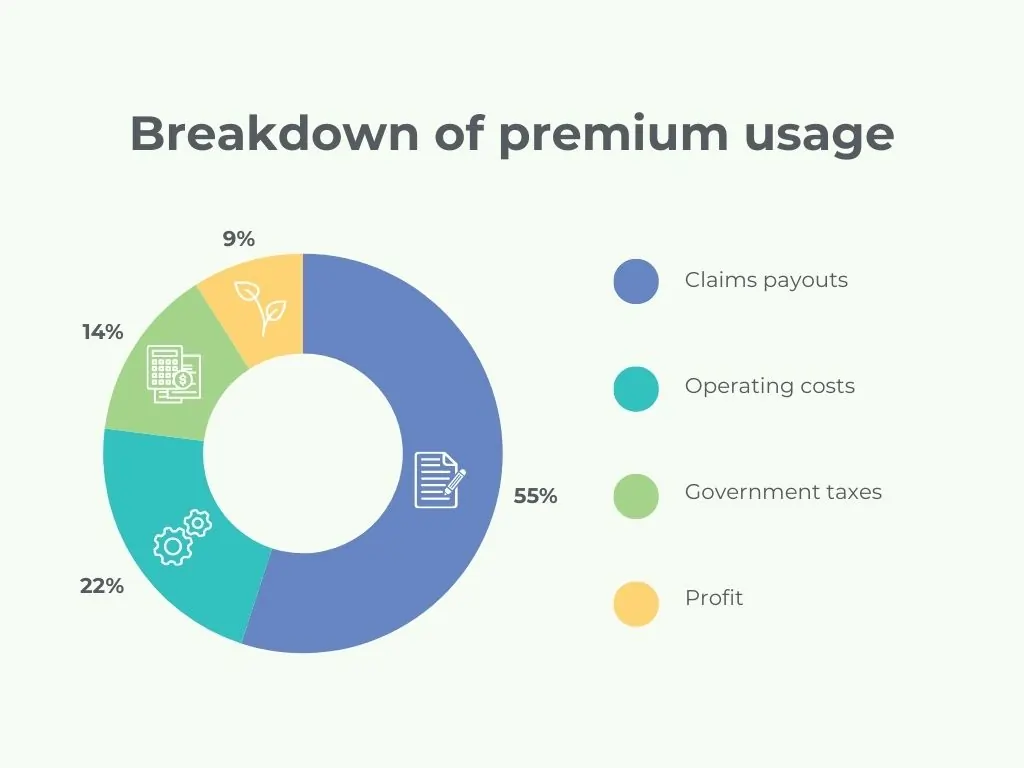

According to the Insurance Bureau of Canada, premiums are spent by insurance companies as such:

- 55% of premiums are returned to policyholders as claims payouts

- 14.1% is returned to communities as various government taxes on insurance

- 21.7% of premiums go to operating costs

- Finally, 9.2% of premiums are profit

You might be surprised to learn just how much of customer premiums are used to pay out for insurance claims. When you consider that, in 2022 alone, Canadian P&C insurers paid out $42 billion in claims, you can see why that might be.

How insurance works

When policyholders pay premiums, whether monthly or annually, that money is then used to contribute to a larger “pool.” This is what insurance companies draw from when settling claims made by clients within their policy period. As you likely know, you’ll only be covered for losses specifically covered by your policy – and not expected events, maintenance losses, or intentional damages.

As we’ve covered, the pool of premiums is used to pay operational expenses and taxes and provide insurance companies with profit. A certain amount of money is also set aside as a “legal reserve,” which is a minimum amount that an insurance company is required to maintain to ensure they’re able to pay a larger number of claims in a short period, such as if a natural disaster were to strike.

How premiums are calculated

Insurance premiums aren’t standard for all policyholders. Everyone will pay a different amount depending on their individual factors and the kind of insurance they’ve purchased. For example, life insurance premiums are dependent on the age you were when you purchased the policy, your current health, the length of term you’re looking for, etc.

Car insurance, on the other hand, is based on the make/model of car you drive, how far you drive it, your driving record, past claims, where you live, etc. It can also be influenced by your age and gender.

Why do these factors raise or lower the cost of your insurance? It all boils down to risk. For example, younger drivers are statistically more likely to get into traffic collisions than older drivers. As a result, younger drivers may be charged more for their insurance premiums than older drivers.

Mitch works with over 70 of Canada’s top insurance companies to aid clients and help them get great coverage at an even better price. Chat with one of our brokers today for advice on how to save on your insurance premiums.